Aggressive Call writing at ATM/ OTM strikes holds positive bias

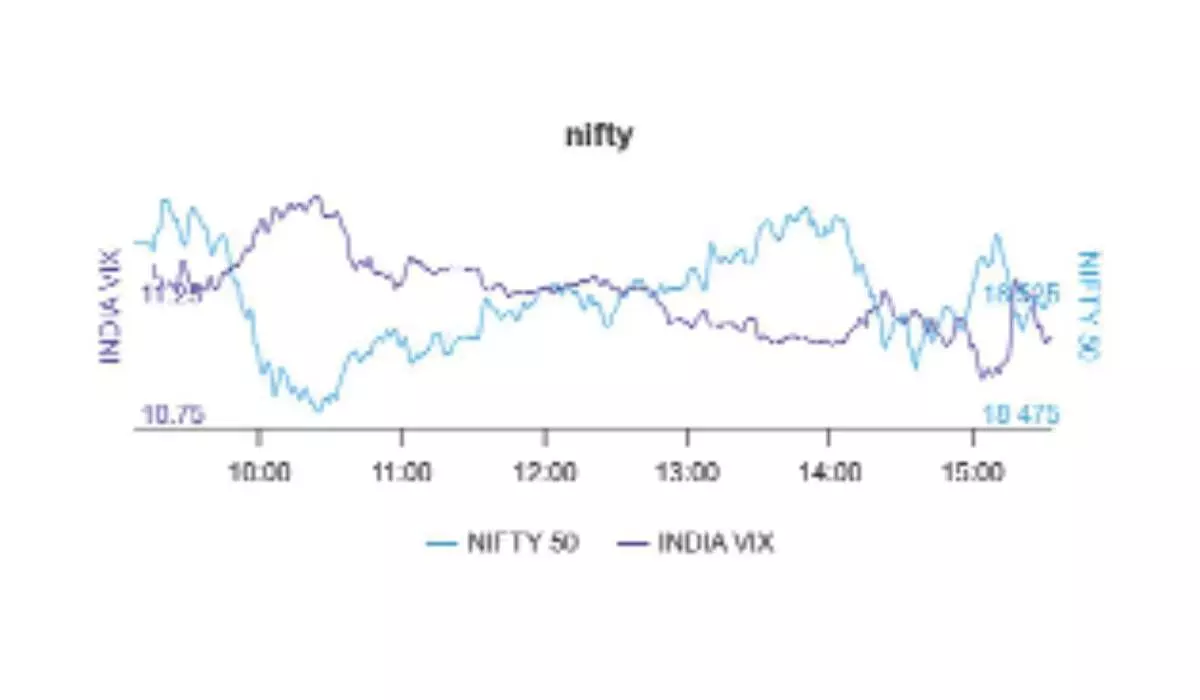

Put-Call Ratio of OI for the week at 1.38 indicates upward move; Fear gauge declines 4.07% to 11 level, one of lowest levels seen in last 2 yrs; Volatility is expected to rise

image for illustrative purpose

The latest options data on NSE after last Friday session points to upward moves in resistance and support levels for the week ahead. The resistance level moved up 500 points to the 19,500CE, which has highest Call OI followed by 18,600/ 18,700/ 19,000/ 19,100/ 18,500/ 18,900 strikes, while 18,600/ 18,800/ 19,500/ 19,200/ 18,500/ 18,800 strikes recorded heavy addition of Call OI.

And the support level also rose by 200 points to 18,500PE. Coming to the Put side, maximum Put OI is seen at 18,500 followed by 18,600/ 18,300/ 18,100/ 18,000/ 17,800 strikes. Further, 18,500/ 18,600/18,000/17,800 witnessed reasonable to heavy build-up of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “From the derivatives front, highest Call writing was observed at 18,600 strike, whereas on Put side the highest Open Interest concentration is held at 18500 strike.”

The derivatives segment witnessed aggressive Call writing at ATM and OTM Call strikes, while the Put base was placed at 18,500 strike. Hence, fresh positive bias is expected above 18,600 level and till then Nifty is likely to consolidate below these levels.

“Indian markets remained volatile in the week gone by and ended the week almost near an unchanged line as Nifty closed above 18,500 level, whereas Bank Nifty closed around 44,000 points. On a weekly basis, auto, FMCG and pharma sectors performed well, whereas profit booking was seen in energy stocks,” added Bisht.

BSE Sensex closed the week ended June 2, 2023, at 62,547.11 points, a minute gain of 45.42 points or 0.07 per cent, from the previous week’s (May 26) closing of 62,501.69 points. During the week, NSE Nifty edged up by 34.75 points or 0.18 per cent to 18,534.10 points from 18,499.35 points a week ago.

Bisht forecasts: “Technically, both the indices are struggling to give a fresh move above their key resistance levels. However, the bias is still in favor of bulls as fresh rounds of buying emerge from lower levels. We recommend traders to keep focus on stock-specific action for upcoming week as Index is likely to remain on a volatile path, as we expect some wild intraday moves in upcoming sessions. On the downside, the 18400-18350 zone can provide some support to the Nifty, while the 18650-18700 zone can add some supply to keep a cap on any sharp upside.”

India VIX fell 4.07 per cent to 11.12 level. The volatility index declined last week towards 11 mark, which is one of the lowest levels seen in last two years. Considering the volatility index level, some uptick in volatility can’t be ruled out and it may trigger some profit booking considering Nifty trading near highs.

“The Implied Volatility (IV) of Calls closed at 9.99 per cent, while that for Put options closed at 10.59 per cent. The Nifty VIX for the week closed at 11.60 per cent. The PCR of OI for the week closed at 1.38,” remarked Bisht.

According to ICICIdirect.com, FII activity in F&O space rose marginally due to MSCI rebalancing towards the end of the month. The net positions in index futures turned negative as FIIs created shorts to the tune of Rs2,950 crore. While in stock futures, activities were largely muted, FIIs have turned net sellers in the index options where they sold nearly Rs3,000 crore during the week. In the last couple of sessions, FIIs have gone long in Put options suggesting expectations of some weakness.

Bank Nifty

NSE’s banking index closed the week at43,937.85 points, a modest fall of 80.05 points or 0.18 per cent from the previous week’s closing of 44,018 points. “In Bank Nifty, highest Call & Put Open Interest concentration is at 44,000 points,” observed Bisht.

| F&O Trading | ||||

| Product | Volume | Value (₹/ lakh) | OI | PCR |

| Stock Futures | 7,08,640 | 51,69,848.96 | 29,93,127 | - |

| Index Options | 14,77,72,913 | 48,92,753.53 | 1,05,14,454 | 0.98 |

| Stock Options | 28,89,293 | 3,76,195.07 | 21,20,743 | 0.46 |

| Index Futures | 2,41,400 | 24,01,545.43 | 3,09,050 | - |